As you know, I am closely following the ongoing centralization & capture of MakerDAO and DAI. The entire project is spiraling into a centralized disaster that’s just begging for regulated entities to drive it into the ground. There have been noteworthy updates in the last few days that I wanted to call your attention to.

Coinbase custody (a.k.a. capture) of DAI collateral

In my last MakerDAO report, I went into detail about how MakerDAO uses USDC collateral to stabilize its peg. I also reviewed the ongoing effort by Coinbase to custody (or, in my eyes, capture) said USDC collateral.

Coinbase’s proposal to custody one-third of MakerDAO’s USDC was approved by MakerDAO in October 2022. Following this approval, the “on-boarding” process began with members of MakerDAO working with employees of Coinbase to hammer out the details.

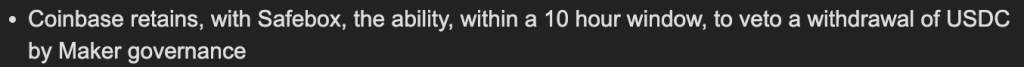

One of the more concerning details that surfaced during a recent “legal review” was the fact that Coinbase stated it would need to retain “a 10 hour window to veto a withdrawal of USDC by Maker governance”.

Obviously, this would mean that if MakerDAO chose to withdraw the USDC for any reason whatsoever (most likely to liquidate it back into DAI), Coinbase would have 10 hours to say “no”.

Why would Coinbase say “no”? Well, any reason that they choose! Perhaps out of legal fears. Maybe they don’t have the money any more. Or, who knows, maybe they just woke up in a bad mood that day.

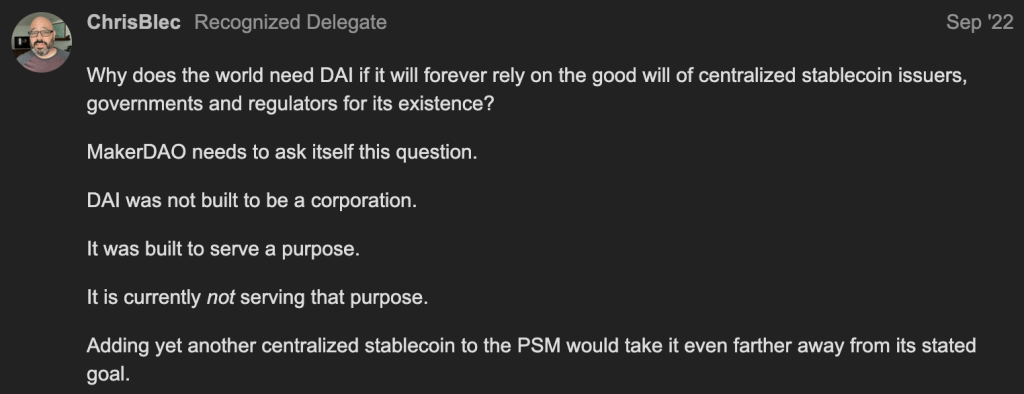

How can DAI possibly call itself decentralized if is not only primarily backed by centralized stablecoins, but it doesn’t even have access to those centralized stablecoins without the kind permission of a centralized custodian? Obviously, it can’t.

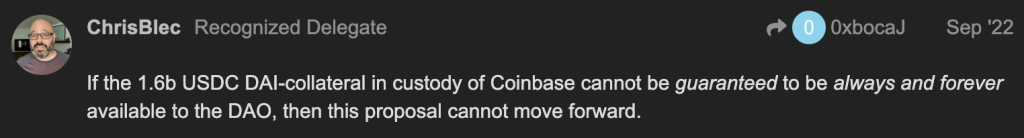

During the discussion phase and prior to voting, one of my main concerns as a Maker delegate was the fact that, if approved, Coinbase would act as a barrier between MakerDAO and it’s most lifeblood – the collateral for circulating DAI.

As far back as September 2022, I was very outspoken about the fact that this deal would be existentially dangerous to MakerDAO and DAI if Coinbase could not guarantee unfettered access to the custodied funds.

But, to no avail. I was ignored, the proposal moved forward and was ultimately approved by MKR delegates who were crowned by Rune Christensen, MKR whale and co-founder of MakerDAO. Rune was a supporter of this deal from the start and didn’t hide that fact as it progressed.

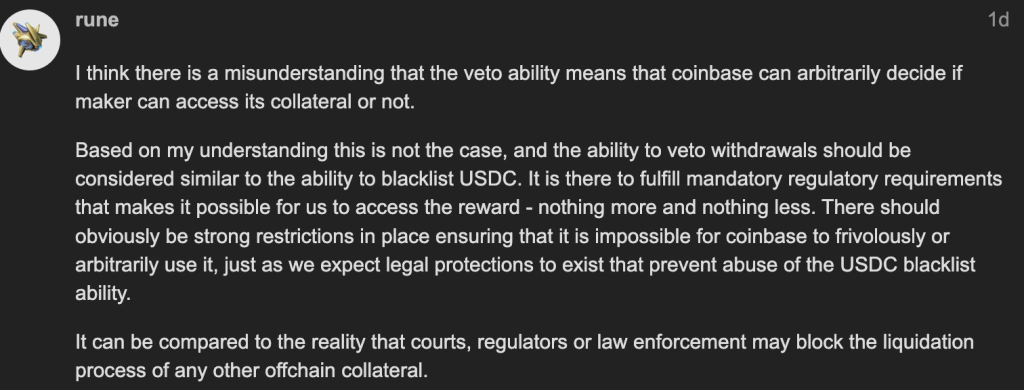

Rune is also a supporter of Coinbase having this 10 hour veto window. Just yesterday, he tweeted in defense of it.

This begs the question: Why would the co-founder of the DAI project now be supportive of a regulated and centralized custodian holding the keys to the existence of the entire MakerDAO project?

Answer unknown. Comment below if you know it.

You can read the entire “legal review” and subsequent replies here.

(NOTE: Just prior to publishing this post, the “legal review” was strangely edited and replaced with a placeholder post. You can see the original by clicking on the pencil/edit icon on the first post.)

Gemini’s “Just Trust Us” Moment

Yesterday, Tyler Winklevoss of Gemini posted on MakerDAO’s forum what can best be summed up in just three words: “Just Trust Us.”

It’s no secret that Gemini has been going through some tumultuous times since to the disintegration of Genesis Trading. For years, Gemini white-labeled Genesis’ service as “Gemini Earn” and offered depositors the chance to earn yield on their crypto. I don’t need to explain to you what has happened over the last few months as several of these schemes came crumbling down, including Genesis.

While pitching Gemini Earn during its existence, Gemini bent over backwards to minimize the risk notifications and make depositors feel far more comfortable than they should have been sitting in those positions. Now, Gemini appears to be trying to do the same thing with MakerDAO.

Back in September 2022, Gemini approached MakerDAO with an offer. If MakerDAO offered a GUSD PSM, Gemini would pay Maker 1.25% APY on any GUSD that was held there.

Obviously, as a perpetual opponent of centralized stablecoins backing a “decentralized” stablecoin, I was immediately opposed to adding more GUSD to what was already a hot centralized mess.

But, the Rune-appointed delegates disagreed with me, and the GUSD PSM was deployed with a 500m GUSD debt ceiling. This means that it would support up to 500m GUSD deposited which would result in 500m DAI being minted in exchange.

The 500m GUSD rapidly appeared and were deposited into the PSM by an unknown party. The fact that no one knows exactly who deposited these funds is a whole other story for a whole other time.

So now we have 500m DAI circulating in the world that are backed by the 500m GUSD in the PSM.

Then Gemini Earn implodes, causing considerable fear in the marketplace. We’ve witnessed multiple CEXes lie to us about their level of solvency in the past few months. Is Gemini really any different?

Discussion begins within MakerDAO about whether having GUSD represent 8% of circulating DAI’s collateral is worth it for a relatively small sub-2% annual return. Of course, I never thought this deal was wise from the start. But for others, it took this level of destruction for them to begin to question their past decisions.

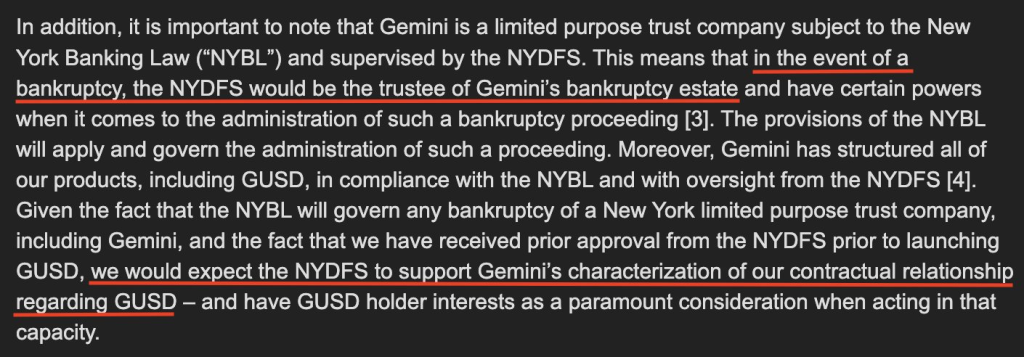

Circle back to the start of this post, and Tyler Winklevoss shows up again in MakerDAO forums with a post to try to calm everyone’s nerves, explaining all of the reason that no one should worry about the robustness of GUSD or Gemini as a business, followed by a massive legal footnote explaining what should happen in the case of a Gemini insolvency.

Lots of “would” and implied “should” in this blurb. It all boils down to “trust us, we thought this through, we set this up the best we could, it should all work out just fine in the end”.

There are currently two MakerDAO polls running to ponder the idea of getting rid of the GUSD that was just onboarded. Consider these to be “Do we believe Tyler or not?” polls.

Simultaneously, a group of MKR insiders has surfaced suggesting that they should form a “working group” that would collab with Gemini and decide whether or not the risk is tenable.

While all of this is going on, DAI remains at risk with 8% of circulating DAI being backed by GUSD due to poor decision-making by the DAO.

What to do?

Every MakerDAO real-world deal over the past few years has increased the amount of faith that Maker is required to have in real-world legal systems, real-world financial systems and real-world regulatory systems. This is resulting in the total undoing of Maker’s decentralization.

MakerDAO is a complete mess, to be honest.

Let’s cut to the chase:

- Allowing Coinbase to have “veto” power over one-third of Maker’s USDC is batshit crazy.

- Continuing to harbor GUSD with the hope that a bankruptcy court would rule in Maker’s favor in the event of a Gemini insolvency is batshit crazy.

Maker’s Rune-appointed delegates do not want to lose the compensation that they receive solely because of Rune’s delegated votes. They will do what they think that Rune wants them to do.

Rune has publicly said that he supports these centralized schemes.

I fully expect MakerDAO to continue to murder itself with these real-world deals, and I suggest that you play DAI accordingly.

- Think twice about holding DAI. If anything goes wrong with these centralized entities, DAI could unpeg and become worthless. Consider swapping it for other stablecoins or crypto assets.

- Be careful in DAI liquidity pools like 3Pool. If DAI goes down while you hold 3Pool, you go down with it.

- If you open a Maker vault with crypto (or already have one open), your crypto should still remain safe if DAI depegs. Best case scenario, you can re-buy DAI below $1 to pay off your loan at a discount to release your crypto.

- MKR token will suffer if DAI gets attacked by Coinbase, Gemini or anyone else. Be careful here.