At first glance, Ethereum Layer 2s (L2s) seem to offer so many benefits over Ethereum mainnet that they should be a no-brainer to use for just about every purpose.

Even someone as cynical as me can acknowledge that L2s are faster, cheaper and more efficient to use for everyone from builders to degens. That’s simply fact.

So why wouldn’t someone want to use an Ethereum L2 in many or most cases? Why would some people choose to continue paying high fees and waiting longer for transactions to confirm on mainnet?

It all boils down to trade-offs.

A golden rule of cryptocurrency and open blockchain is this:

There are an endless number of crypto solutions that are capable of speeding things up, making things cheaper, or adding some other form of efficiency to the way that open blockchains work. But every single one of them is trading away decentralization and/or security to achieve it.

Some of these solutions trade away minuscule amounts of decentralization and security, but L2s trade away all of the decentralization and security that builders and users previously had.

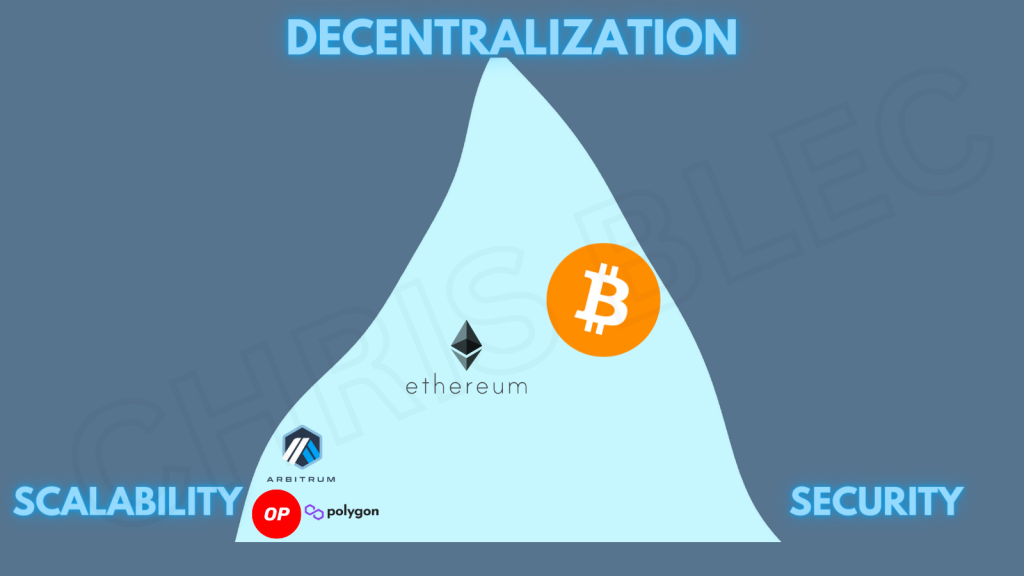

The above diagram showcases what is known as the blockchain trilemma. All open blockchain tech lands somewhere on this chart, and there is no “best place” to be. A blockchain that perfectly balances decentralization, scalability and security would be in the exact middle of the chart. However, this isn’t necessarily the optimal state, as it would require trading away security in favor of scalability, which generally isn’t a great idea.

All existing Ethereum L2s currently reside in the left corner of the triangle, entirely optimized for scalability. As of today, all L2s have chosen to foresake all decentralization and all security in favor of scalability.

This isn’t due to limitations in the technology. In fact, it is possible to have an L2 that balances the three just almost well as Ethereum mainnet does! The reason for the L2s placement on this diagram boils down to the choices of the respective development teams.

All of the teams have opted for the following:

- All transactions are processed on one server called a “sequencer”, giving the companies running these servers the ability to censor transactions and re-order transactions within blocks as it sees fit (extracting MEV). This sacrifices decentralization since one company can deny any transaction.

- The logic underlying each chain is modifiable by a multisig admin key. The changes that this admin key can make to the L2 blockchain are unlimited. It can even go so far as freezing or draining funds in any targeted user’s wallet. This sacrifices decentralization and security, since users are not capable of verifying the security of the multisig.

- The network of validators for each blockchain is whitelisted and tightly controlled by the development company behind the L2. If requested, the validators could simultaneously shut down and halt the chain. This sacrifices decentralization since one company is choosing all node operators based on its own criteria.

These choices were made by the companies behind the L2s for a variety of reasons. However, based on my research, the two most critical reasons for these choices are:

- They are not 100% confident in their tech. They are concerned that their tech could fail and that they’d need god-like control over the chain to remedy a future problem.

- They are concerned about staying in compliance with regulations and laws, and they want to maintain the ability to comply with court orders and government demands.

Each of these L2s is built by a fully-doxxed company, each of those companies is running a server that’s processing billions of dollars in financial transactions, and each of these companies has lawyers that know exactly what is going on. This means that each of these companies is likely a money transmitter under existing law. If they were to eliminate their centralized control over these chains, they would not be able to comply with these laws. Their lawyers simply won’t allow it.

Decentralized governance does not fix this. Optimism and Arbitrum have recently airdropped governance tokens to thousands of past users of their networks, but these governance tokens are totally meaningless as long as the multisigs exist. Every single token governance decision can be vetoed by the multisig, and since there is no timelock, the multisig can take unilateral and immediate action that the DAO wouldn’t have time to override or otherwise control.

L2s sure are starting to sound a lot like CEXes or even banks, aren’t they?

Due to these trade-offs, using any L2 today requires full trust in the small company that developed and operates the chain. “Not your keys, not your crypto” does not apply on an L2. Until these trade-offs are remedied (which very well may be never), your money will always remain at the mercy of the development company running the chain.